When can I retire?

HOW WE WORK

A Seamless Transition ToThe Retirement You Want

Whether you dream of buying a one-way-ticket around the world or spending your days basking in the sun with a crossword in your hand, it’s the freedom of knowing you have the finances to finally do what you want, when you want to do it, which makes the perfect retirement.

So now that you’ve paid off your mortgage and your kids have flown the nest.

Don’t let the burden of managing your financial future stop you from enjoying your new-found freedom, regardless of the way you want to enjoy it.

It’s not just the kids that get to have that gap year, now you have the time we’ll make sure you have the money to take that ultimate round the world gap year.

WE PUT

Your Money To Work...So You Can RetireFrom Work

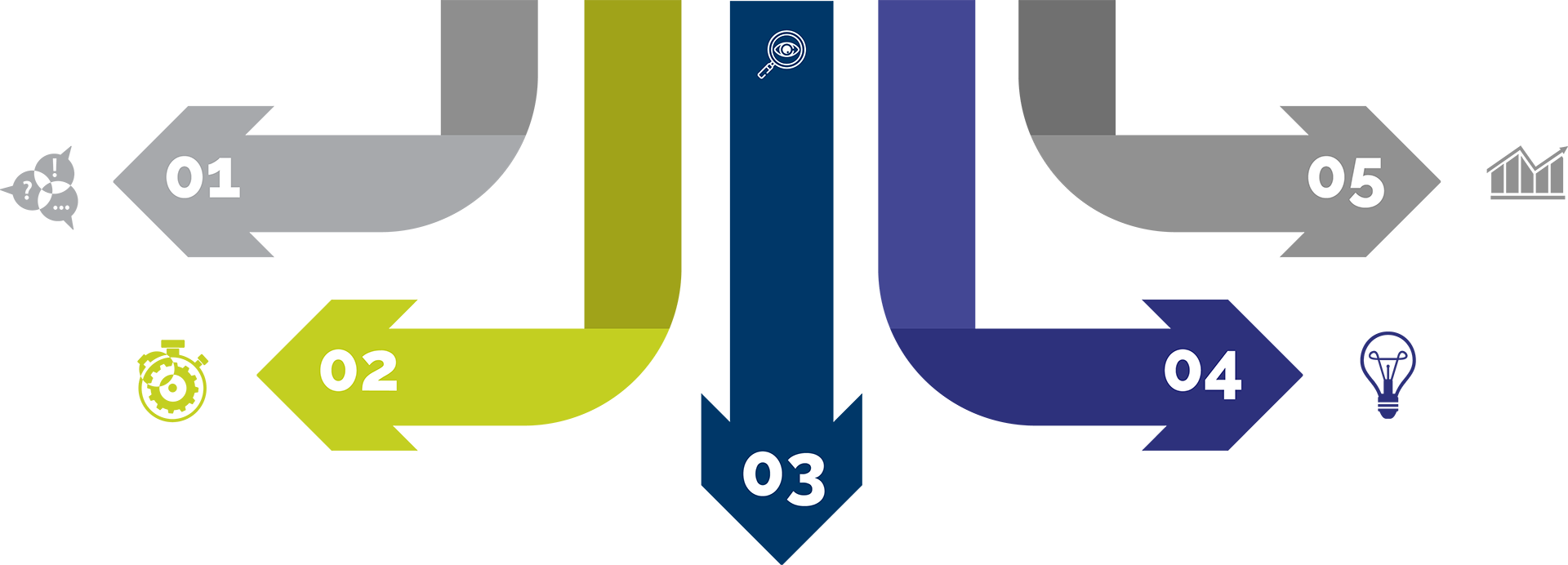

At Lifestyle Wealth Partners our 5-step end-to-end approach to retirement planning ensure you can maintain a comfortable lifestyle now, confident in the knowledge that we are putting your money to work, so you can retire from work.

Our 5-step end-to-end approach allows us to tailor a financial solution based on your needs and desires…a solution that provides you with the very best chance of success. And a solution that continues to evolves with your needs

Step 1

Looking at where you and your finance are today

Step 2

Understanding what your ideal retirement looks like and when you’d like to retire

Step 3

Tailoring a retirement plan that turns your dreams into a reality while minimising your risk

Step 4

Putting your plan into action, working with you and your other professional advisors.

Step 5

Keeping your plan on track to unsure you achieve the retirement you deserve

OUR

Disciplined Approach

to helping you build and manage your plan for financial independence includes expertise in:

- Superannuation investment and rules

- Investment options

- Tax and retirement income strategies

Pension strategies:

- Self-managed or retail super funds

- Estate planning

- Wealth management

- Coping alone, after divorce or widowhood

And because retirement planning is a key part of our business, you can relax and enjoy your retirement, confident in the security of making the right decision…confident that every box is ticked on your retirement planning checklist and the peace of mind knowing you are safe and secure.

Are You Missing$300,000?

An often overlooked, but very important aspect of financial planning is how simple saving strategies can really add up over time. Take the case of ‘Lisa’ and ‘Tim’, a couple in their mid-50s, who came to Lifestyle Wealth Partners for financial advice once they started thinking about their retirement.

“When we sat down to chat about their finances and I discovered they had paid off their mortgage nearly a decade ago, I cut to the chase asked them straight out, ‘where’s the missing $300,000?’,” says David Lunn.

“At first, Lisa and Tim looked confused, not understanding what I was talking about. Then, as the penny dropped, they literally turned white in front of me.”

“They realised I was talking about the $2000 a month that was no longer going towards mortgage payments, but had not been invested elsewhere once the mortgage was paid. The money had simply been frittered away, whereas if it had been invested wisely, Lisa and Tim would have been $300,000 richer.”

Luckily for Lisa and Tim, their story had a happy ending. With some simple budgeting

strategies and careful and considered financial planning, the team at Lifestyle Wealth

were able to get their finances back on track and accumulate enough wealth to ensure

their comfortable retirement.

Let's talk.

We provide you with peace of mind – manage your risk and ensure you don’t miss out on opportunities.